Tesla’s stock performance has been a roller coaster this year, with the company still reeling from a year-to-date (YTD) slump. Despite a recent uptick, TSLA remains underwater, raising questions about its future performance. However, the recent decision by the Federal Reserve to cut interest rates may provide the electric vehicle (EV) maker with a much-needed boost.

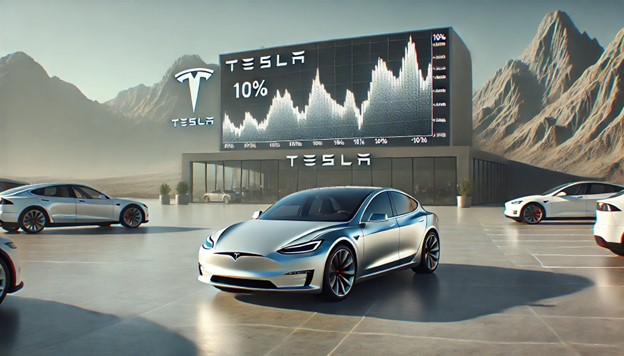

Tesla Stock Pumps 10% in a Week

Last week, Tesla’s stock saw a significant rise, pumping 10% in value over the span of just a few days. This comes after months of fluctuating prices, with the stock falling 2% last Friday but quickly rebounding as markets digested the news of interest rate cuts. Tesla’s upward trend appears to be driven by optimism surrounding its future sales outlook, especially now that financing options for buyers are becoming more affordable.

Interest rates play a critical role in car purchases, particularly for high-ticket items like electric vehicles. With car loans becoming cheaper, analysts believe that more consumers will be incentivized to buy EVs, potentially driving up Tesla’s sales in the near future.

Shares Still Underwater YTD

While Tesla has shown recent signs of recovery, it’s important to remember that the stock is still down compared to its performance earlier in the year. At its lowest point, TSLA was down 40% YTD, a steep decline that has worried many investors. A combination of production challenges, stiff competition from other automakers, and global economic uncertainties has made it difficult for Tesla to regain its footing.

Despite these challenges, the company’s fundamentals remain strong. Tesla continues to innovate, pushing boundaries with its EV technologies, energy storage solutions, and self-driving capabilities. Investors are now watching closely to see if the recent rate cuts will help Tesla climb out of its slump.

How Rate Cuts Impact Tesla’s Performance

The relationship between interest rates and Tesla’s stock price is becoming increasingly clear. Lower rates generally mean cheaper financing, and for car manufacturers like Tesla, this can lead to an increase in sales. With the Federal Reserve cutting rates by 0.5% (or 50 basis points) and possibly cutting rates again before the year ends, the environment for car financing has significantly improved. This is good news for Tesla, as the EV market heavily relies on consumers taking out loans to afford their vehicles.

In addition to the US Federal Reserve’s actions, the European Central Bank (ECB) has also slashed rates twice this year. With interest rates dropping across key markets like the US and Europe, Tesla stands to benefit from a broader shift in consumer behavior. Lower rates may help offset the decline in revenue growth, which has slowed to just 2% year-over-year.

Tesla’s European Sales Hit a Snag

While Tesla’s prospects in the US market look promising, the same can’t be said for Europe. According to preliminary figures from data platform ACEA, Tesla’s revenue in Europe plummeted by 36% in August compared to the same month last year. This sharp decline is a cause for concern, as Europe represents a significant portion of Tesla’s global sales.

However, the recent rate cuts by the ECB might help reverse this trend. Lower financing costs could encourage more European consumers to consider purchasing electric vehicles, giving Tesla a potential path to recovery in the region.

The Broader Impact on Car Stocks

It’s not just Tesla that’s poised to benefit from lower interest rates. The entire car industry could see a boost if investors begin to anticipate a rise in sales. Lower rates make car loans more attractive, which could lead to an uptick in overall car sales. Traditional automakers and EV companies alike may experience increased investor confidence as consumers take advantage of cheaper financing options.

Conclusion: Will Rate Cuts Help Tesla Recover?

Tesla’s stock performance in 2024 has been anything but stable. However, the recent 10% surge suggests that the market is beginning to respond positively to the Federal Reserve’s decision to cut interest rates. As financing becomes more affordable, Tesla may see a boost in sales, potentially helping the company recover from its YTD slump.

That said, challenges remain, particularly in the European market where Tesla’s sales have been declining. Only time will tell whether the rate cuts will be enough to lift Tesla out of its slump for good. Investors will be watching closely as the year progresses, hoping that the combination of lower rates and improved sales can turn Tesla’s fortunes around.